The memecoin market is on fire once again, propelling the sector to a $70 billion valuation with $19 billion weekly volume. If you want exposure, this is how we would be buying! Let's jump in…

Memecoins are a unique intersection of internet culture and finance. They are fun, easy to understand, and one of the best speculating tools, and if you play your cards right, they can deliver returns that make Wall Street suits cry in the corner.

With BTC hovering just below its all-time highs, participants are hungry for risky plays, and the broader memecoin market is picking up.

In this report:

Memecoin market snapshot

OG vs. Newcomers

Emerging trends

TMG’s take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Memecoin market snapshot

After a period of chop and silence, the memecoin sector is on a rollercoaster again. The charts don't lie, over the past couple of weeks, we've seen some spicy price action. The total market cap of the memecoin sector is up 36% to $70b market cap in the last 7 days, while volumes are 4x to reach $19b in just a week

However, despite the massive gains, the sector is still down about 40% from its ATHs of $127b market cap. Yeah, there is still a lot of catching up to do, and this pump is nothing compared to what we have seen between November 24 to January 25.

What's wild, though, is how memecoins are straight-up flexing on every other crypto sector yet again. AI tokens? Layer 1s? DeFi? They're all behind in terms of performance. Memecoins are leading the pack as the best-performing asset class in crypto over the last few weeks.

This is textbook mean reversion in action. When the market turned risk-off, memecoins took the hardest gut punch. But now? Greed's back in the driver's seat, and these memes are roaring back with double-digit daily returns. Additionally, people are bored, inflation is eating savings, and traditional markets are slow. Memecoins offer a middle finger to that system: a chance to gamble on something that doesn't take itself seriously but could still make you rich quite fast if played right.

Thus, the sector is alive once again. Projections estimate the memecoin market could grow to $925.2 billion by 2035, with a compound annual growth rate (CAGR) of 26.7% from $70 billion in 2025. What does it mean? There is still a massive upside potential for this sector, and most of the meme action is happening on two chains: Solana and Ethereum. Solana accounts for 39.6% of DEX trading volume in Q1 2025 and 15% of the memecoin market cap, driven by low transaction costs and high throughput.

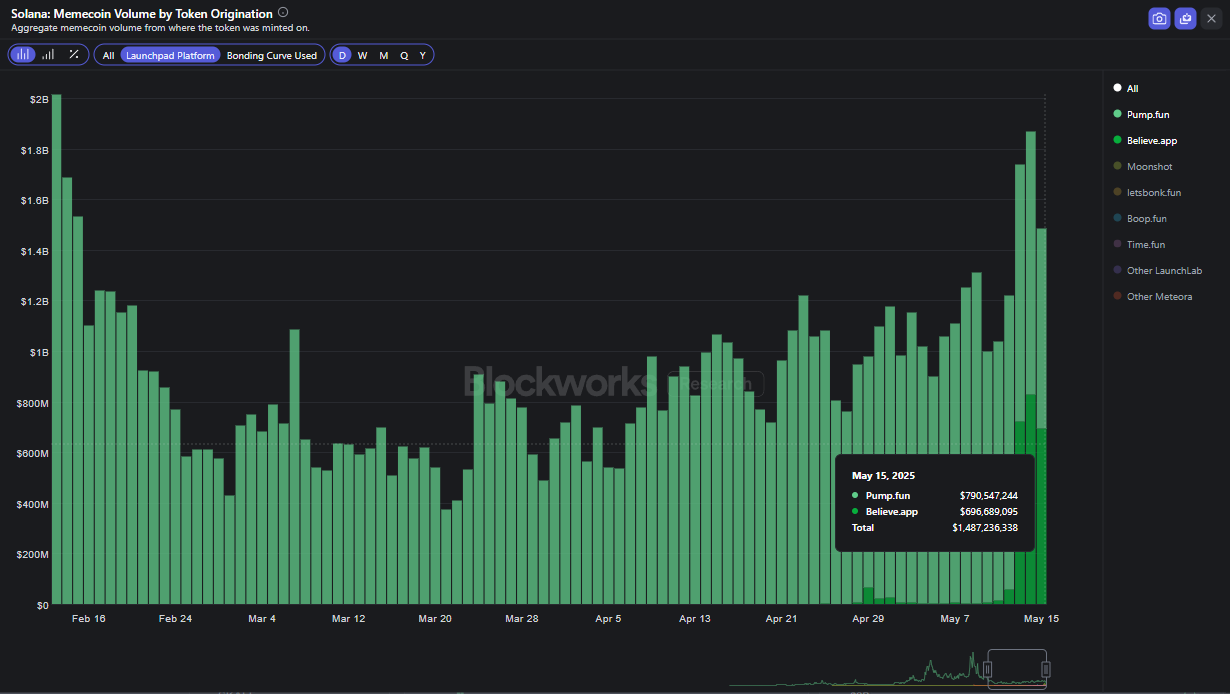

Ethereum still hosts about 45% of all memecoin projects and 32 out of the top 50 memecoins, leading in market cap and trading volume due to its strong liquidity and network effect. However, in the last leg up, PumpFun memes (on Solana) have been leading in terms of performance relative to EVM memes, which is interesting considering that PumpFun memes used to be heavily manipulated, sniped and extractive.

Hyperliquid's HyperEVM chain has also hosted some meme activity, however, the ecosystem is very nascent, and it will be hard for memes to take off there without improving the onboarding process.

OGs vs. newcomers: Memecoin dynamics

What's interesting is the split between old and new memes. Established players like FARTCOIN and PEPE are soaking up most of the capital right now. This is likely due to the listings they have. Most of the 2024 memes have a major CEX listing, and thus liquidity can easily flow to them. However, on-chain memes are slowly heating up, and we believe there will be a true runner that will make trenches great again.

It happened in previous bear-to-bull market periods as well. Investors initially flock to familiar names during renewed optimism, but eventually chase new shiny things as the cycle progresses. For example, in 2021, DOGE pumped before runners like Shiba and SafeMoon emerged.

The OG vs. newbie split mirrors human psychology. Established tokens feel "safe" because they've survived a cycle, but their upside is capped - FARTCOIN isn't doing another 1000x. New memes, meanwhile, are high-risk lottery tickets. The trick is finding ones with staying power: a strong community, a catchy narrative, and a big idea/movement to cause a retail mania.

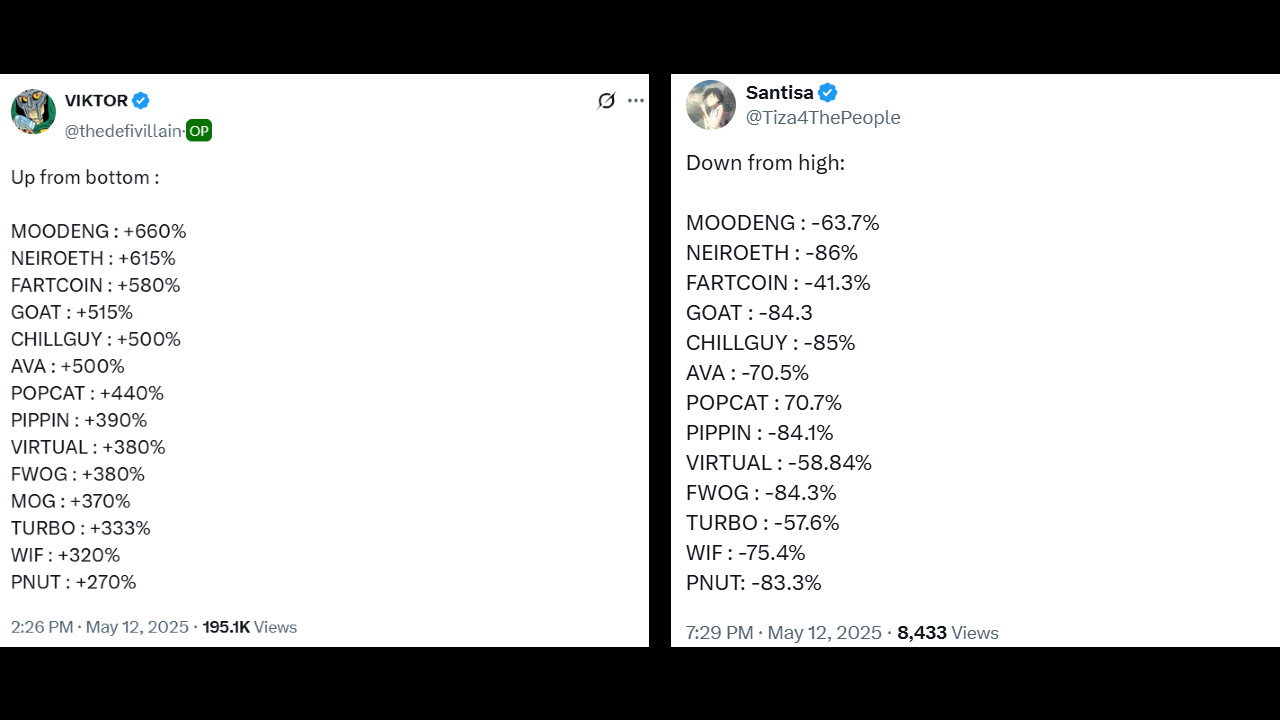

However, despite massive gains, the memes are still down 70%-80% from their highs on average. Therefore, there is no need to FOMO or feel that you have missed out. It is nearly impossible to time the bottom perfectly, and most of the holders are still down a lot.

Emerging trends: The rise of ICM and beyond

In the meantime, while established memecoins are pumping, some new narratives are forming. One of them is ICM - Internet Capital Markets. Unlike traditional memecoins tied to animal themes or internet memes, ICM aims to represent a broader "paradigm shift" toward decentralised platforms that empower creators and communities to monetise ideas directly through tokenisation.

The narrative is fueled by platforms like the Believe app on Solana, which allows users to turn tweets/ideas into tokens instantly via projects like $LAUNCHCOIN, fostering a creator economy where social traction translates to financial value.

The volume of these launchpads is picking up and rivalling successfully with PumpFun. However, despite sounding fancy, we believe it is just repackaging of old ideas. We had ICOs, NFTs, and Memes, AI agents previously, and the ICM is the latest iteration of the old ideas, and these are essentially wrapped memecoins if you dig deeper philosophically. As a category, it is likely to be smaller than the AI agent narrative we had a few months back.

However, we can already see a narrative push on social media, and many influencers are jumping on this wagon. Therefore, we are sceptical about it at the moment, though we are keeping a close eye on it. It is important to remember to stay safe, as this recent rally might end up being a bear market relief rally, which is not ideal for the formation of new categories. We are watching closely for upside confirmations.

TMG’s take:

Currently, 1 in 2 adults in the U.S. gamble, and casino revenues are soaring, hitting a staggering $160 billion a year, with no signs of slowing down. In fact, it is growing by 5%-6% annually. Even more interesting is that nearly half of that revenue is generated online, and digital/crypto gambling platforms are growing.

The message is clear: people crave the thrill of hitting it big, and that desire is only growing stronger by the day. Memecoins offer the same electrifying excitement as gambling but with far better odds and the same potential for massive rewards. With billions of dollars pouring into the gambling industry yearly, memecoins still have massive upside potential, and we can see it already in the market.

A $70B market cap is still small potatoes next to the $3T crypto market. Memecoins are the ultimate retail choice - accessible, memeable, easy to understand and play with. However, the market has entered into “Greed” and is almost getting into the “Extreme Greed” phase in terms of sentiment.

As Warren Buffett says, be fearful when others are greedy, and we would be fearful of FOMOing into memecoins just yet. That being said, our general market stance has changed, and we are looking for entries and potential 20x-100x plays moving on from here. The best memes are born in disbelief, not euphoria.

The market has spoken, and memes are back in the game, however, they are still way down from ATHs. As we said, this can end up being a bear market bull trap, therefore, it is important not to rush into things without the market confirming a new cycle. Our base case is that we will see a pullback and chop there for a while before going into strong price discovery.

In the meantime, if you are feeling underexposed, you can potentially use concentrated liquidity pools as a way to gradually get exposure to leading memes and majors such as SOL, BTC, FARTCOIN, WIF, SPX, etc, which DCA way down while earning trading fees if the prices were to pull back substantially.

We would be careful of adding significant spot positions on memes because the market is overbought and is in “Greed” sentiment. Therefore, we would be looking for a pullback to reassess what memes we want to add to our